“The best years of your life” unfortunately come with a hefty price tag in the form of a student loan. Repaying it might seem impossible, but luckily now we have apps to help, like SLOAN. It’s available to download now on iOS and coming soon to Google Play.

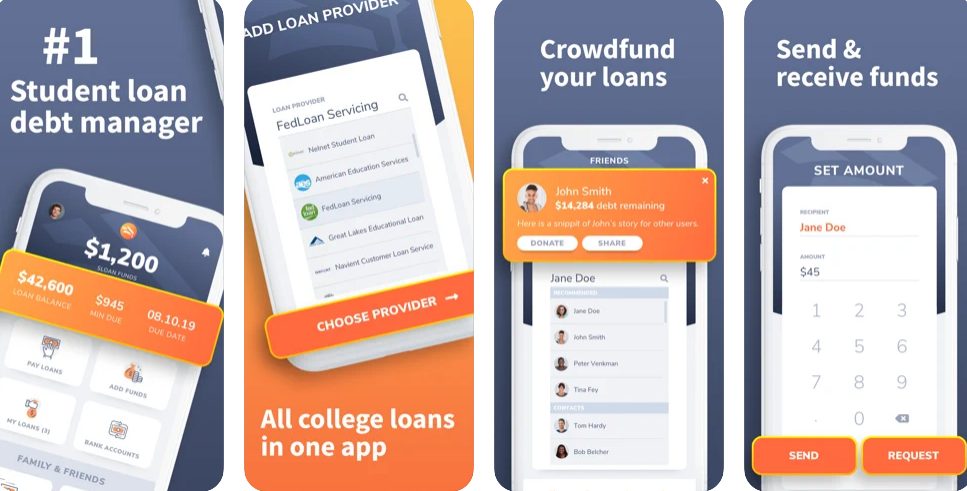

On the surface, it’s a super intuitive dashboard that helps you keep track of your student loan (or loans, if you’re lucky enough to have more). From interest rates, amount due and payment due dates, you’ll always be able to stay on top of things.

But where the app shines in the myriad ways of helping you save and pay off your loan faster. The app has different repayment strategies, from ‘Highest interest first’ to ‘Snowball’, aimed at helping you repay your loans as efficiently as possible.

And how exactly does the app help you pay them off faster?

The first and most commonly used way is by rounding up your credit and debit card purchases, then putting that change towards your student loans. This isn’t a new concept, and you’ll find stories online of people saving 100s of dollars a month without even realizing. That alone can help you pay off thousands over the course of a few years. You can get your friends and family to help you out and do the same, if you can convince them!

Peer to peer giving is another way SLOAN can help. Between friends, family and members of the SLOAN community, people can generously contribute towards your repayments with the confidence that every penny goes towards your loans.

Employers can help you out, too, by joining the Employee Benefit Plan. It’s purposely set up to be as simple as possible, so don’t feel like you’re inconveniencing your employer by asking them.

With so many ways to boost your savings and repay your loans more efficiently, SLOAN can help knock years off your student loan. Sound good? Check out the app on iOS and coming soon to Google Play today!